When you’re starting out trading, the size of your deposit can be a big factor in how much success you have. A small deposit might limit your ability to make big trades, but it can also help you to focus on learning and build your confidence before investing more money. In this article, we’ll take a look at Plus500 – a popular online broker that offers trading with a small minimum deposit. We’ll also give some tips on how to get started trading with a small deposit.

What is Plus500?

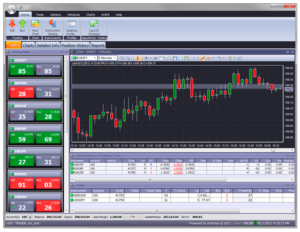

Plus500 is an online broker that offers CFD (Contract for Difference) trading on a wide range of assets such as forex, stocks, indices, commodities, and cryptocurrencies. CFD trading allows you to speculate on the price changes of an asset without actually owning the asset. Plus500 is regulated by financial authorities in various jurisdictions and offers a variety of account types and leverage options.

Plus500 requires a minimum deposit of $100 for standard accounts and $500 for premium accounts. Standard accounts offer leverage of up to 1:30 and premium accounts offer leverage of up to 1:200. This means that for every $1 you deposited into your account, you can trade up to $30 (or $200 for premium accounts). This can give you much more exposure to the market than if you were only able to trade with your own capital. However, it’s important to remember that leverage can magnify both profits and losses, so be sure to use it cautiously.

Tips For Getting Started Trading with a Small Deposit:

1) Start with a demo account: Before you start trading with real money, it’s important to get some experience first. Many brokers offer demo accounts which give you virtual money to trade with. This is a great way to get used to the platform and try out different strategies without putting any real money at risk. Plus500 offers unlimited demo accounts so you can practice until you feel confident enough to start trading with real money.

2) Set aside some money for learning: When you’re starting out, it’s important to set some money aside specifically for learning. This way, even if you do lose money while you’re still getting the hang of things, it won’t be significant enough to affect your overall finances negatively. Once you’ve mastered the basics and feel confident in your abilities, then you can start increasing the amount of money you trade with.

3) Find a broker with low fees: One major advantage of online brokers is that they usually have lower fees than traditional brokers. Since most online brokers don’t have physical locations, they don’t have the same overhead costs and are able to pass those savings on to their clients in the form of lower fees. Plus500 doesn’t charge commissions on trades or have any hidden fees – what you see is what you get. Plus500 also offers tight spreads on major markets soyou can keep your costs down even further.

4) Keep your emotions in check: It can be easy to let emotions guide your decision-making when trading but this is usually not a good idea. Fear, greed, and hope are all emotions that can lead to bad decisions when trading. It’s important to develop a solid trading plan and stick to it no matter what happens in the market. Remember – there will always be another opportunity; don’t let one bad trade ruin your entire account!

Conclusion:

When beginning your journey into trading, it’s common practice to start small by only investing a small amount of money into your account. This gives beginners time toopractice without putting their finances at risk . Online brokerages like Plus500 understand this need and allow their clients toytrade with leveragethat can provide greater exposureto the markets while only using a small amount offunds from their account .By following these simple tips , novice traders canLimit their downside while still giving themselvesa chance oto earn profits .

Once these traders have developedmore experience , they will then be able tomove onto larger tradesand employ more sophisticated strategies . Until then , begin your journey into the world oftoday by using one offthe many excellent methodsavailable atPlus 500 .